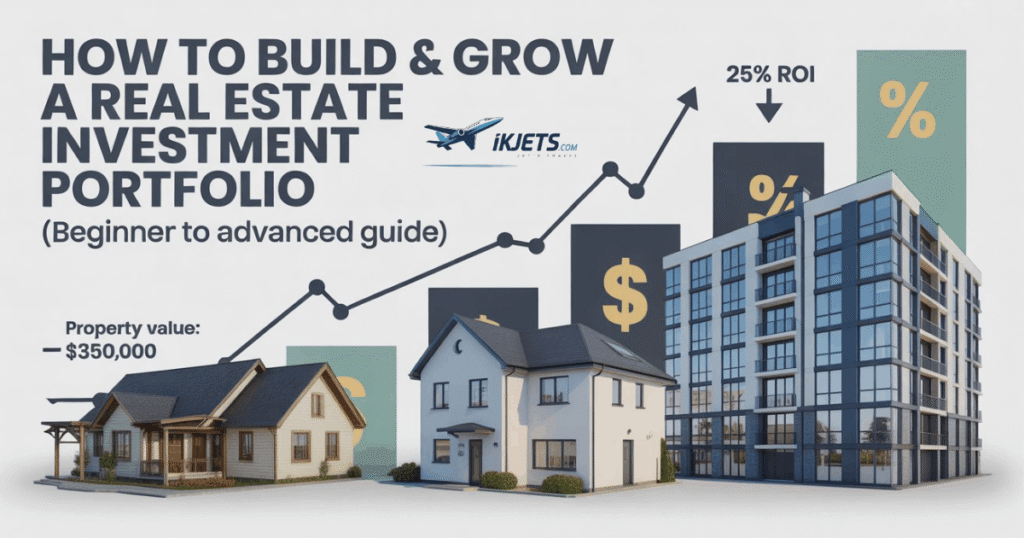

How to Build & Grow a Real Estate Investment Portfolio 2026 (Beginner to Advanced Guide)

Summary: Investing in real estate is one of the strongest ways to build long term wealth in the USA. A real estate investment portfolio includes different properties that generate rental income and property appreciation. Unlike stocks, real estate gives you a tangible asset that you can manage, improve, and rent. Many investors use this method to earn steady income while their property values rise over time. When done right, it can provide both security and freedom.

Real estate also allows for real estate portfolio diversification, which reduces risk and increases stability. If one property faces a vacancy or repair issue, other properties can still earn income. This is why many investors mix investment property types, like single family homes and commercial properties. They also use REIT investing and real estate mutual funds to spread risk without owning many buildings. A balanced portfolio can withstand market swings better than a single property.

Table of Contents

What Is a Real Estate Investment Portfolio? (Definition for USA Investors)

A real estate investment portfolio is a group of properties owned for income and long term growth. It can include rental property portfolio holdings such as single family homes, duplexes, small apartment buildings, and even commercial buildings. The key is that each property earns money in a way that supports the whole portfolio. Many investors begin with one property and gradually add more. This builds a strong foundation for future wealth.

In the USA, investors often use a property investment strategy that combines buy and hold strategy with smart financing. This means they buy properties, rent them out, and hold them for years. The value grows over time while they collect rent. Some investors also use property appreciation to refinance and buy more properties. This method creates a cycle of growth that becomes stronger each year.

Why Real Estate Investing Works in the USA (Market Advantages)

The US housing market is supported by steady population growth and strong job markets in many cities. This creates constant demand for rentals. In many areas, renting is more affordable than buying, especially for young people and families. This drives rental demand and supports rental income. When demand is strong, rents rise and vacancy rates drop. This makes real estate a reliable source of cash flow for investors.

The USA also offers a mature system of real estate financing options. Investors can use mortgage for investment property, FHA loans, and even private financing. These options make it possible to buy property with limited cash. Leverage can amplify your returns when the market rises. For example, buying a $200,000 property with $40,000 down can still earn the same rent as owning it fully. This makes real estate accessible for many beginners.

How to Start Your First Property (Step-by-Step for Beginners)

The first step is to check your financial readiness for investing. This means looking at your income, savings, and debt. Your credit score matters because it affects the interest rate you will pay. A higher credit score can save thousands in interest over time. Many beginners start by saving for a down payment and paying down debt. This creates a stronger financial base and reduces risk.

Next, conduct real estate market research to find the best location. Look for areas with job growth, good schools, and low crime. These areas attract long term tenants. Also check the local rental rates and vacancy rates. The goal is to find a property that can generate positive cash flow. A property that breaks even may still be fine, but positive cash flow reduces stress and improves stability.

Diversifying Your Real Estate Portfolio (Asset Type & Geography)

Portfolio diversification strategies are essential to reduce risk. If all your properties are in one city, a local downturn can hurt your entire portfolio. To avoid this, investors spread their holdings across different states and property types. For example, they may own a single family home in one state and a multifamily building in another. This reduces the risk of job loss or natural disasters in one area.

Diversification also includes mixing residential real estate investing with commercial real estate investing. Commercial properties often have longer leases and higher rent. Residential properties often have more consistent demand and easier management. Adding REIT investing or real estate mutual fund investing gives exposure to large commercial projects without direct ownership. This helps beginners diversify without needing huge capital.

Rental Property Strategies That Grow Your Portfolio

One of the best strategies for beginners is the buy and hold strategy. You buy a property, rent it out, and hold it for many years. Over time, rents rise and the property value grows. This creates steady cash flow properties and long term wealth. It is simple, reliable, and works well for most investors. Many of the richest investors use this strategy because it builds wealth slowly but steadily.

Another powerful strategy is the BRRRR method, which stands for Buy, Rehab, Rent, Refinance, Repeat. You buy a property below market value, fix it, rent it, then refinance to pull out cash. This cash can buy the next property. This method speeds up real estate portfolio growth. It also builds equity quickly because the property value rises after repairs. Many investors use this method to expand quickly without needing huge savings.

Financing Options for Growth (Loans, Refinancing, & Equity)

Financing is the engine that powers growth in real estate. Many investors use mortgage for investment property to buy properties with a smaller down payment. This allows them to buy more properties faster. The key is to ensure the rental income covers the mortgage and expenses. If the property does not cover the costs, it becomes a financial burden.

As you build equity, you can use leverage and refinancing to unlock more cash. For example, if your property value rises, refinancing can pull out cash while lowering payments. This cash can fund the next purchase. This strategy is common in advanced investing. It allows investors to scale faster and build a larger portfolio in less time.

Real Estate Investing Metrics That Matter (Numbers You Must Track)

Real estate investing is not a guessing game. You must track metrics like cash flow, cap rate, and rental property ROI. Cash flow is the money left after paying mortgage, taxes, insurance, and repairs. A positive cash flow means the property earns money every month. Cap rate measures how much income a property generates relative to its price. It helps compare different deals.

Other important metrics include vacancy rate, operating expenses, and rental property expenses. Vacancy rate shows how often a property stays empty. A high vacancy rate reduces cash flow. Operating expenses include repairs, property management, and utilities. Tracking these numbers helps investors make smart decisions.

Property Management Essentials (DIY vs Hiring a Company)

Property management is one of the biggest challenges for investors. It involves tenant management strategies, repairs, rent collection, and legal compliance. A good system keeps tenants happy and reduces vacancy. It also helps you avoid legal issues and costly mistakes. Many investors start by managing their own property. This helps them learn the process and save money.

However, as the portfolio grows, management becomes harder. This is when investors consider a property management company. These companies handle tenant issues, repairs, and paperwork. They charge a fee, but they also save time and stress. Many investors use property management software to track income, expenses, and maintenance. This software helps keep everything organized and improves efficiency.

Advanced Strategies (REITs, Syndications, and Tax Benefits)

Advanced investors use REIT investing and real estate mutual fund investing to diversify without owning more properties. These options allow investors to invest in large real estate projects with smaller amounts of money. REITs also provide liquidity because they trade like stocks. This makes them ideal for investors who want real estate exposure without direct property management.

Tax strategies also play a major role in real estate investing. Depreciation in real estate allows investors to reduce taxable income. Capital gains tax can be lowered through long term ownership and strategies like 1031 exchange. Many investors also use limited liability company (LLC) for real estate to protect personal assets. These strategies improve returns and reduce risk.

Risks and How to Avoid Them (Real Estate Challenges in the USA)

Real estate comes with risks like market downturns, tenant issues, and unexpected repairs. A market downturn can reduce property values and rent. Tenant problems can cause damage and legal issues. Unexpected repairs can eat up profits. A strong plan helps you reduce these risks and stay calm during tough times.

To reduce risk, always do thorough inspections and use insurance. Keep a reserve fund for repairs and vacancies. Diversify your portfolio across locations and property types. Also, keep up with real estate legal compliance and local laws. This protects your investment and ensures long term success.

Case Study: Real Estate Portfolio Growth Example

| Year | Property Type | Strategy Used | Monthly Cash Flow | Equity Built |

|---|---|---|---|---|

| 1 | Single family home | Buy and hold | $250 | $10,000 |

| 3 | Duplex | House hacking | $600 | $30,000 |

| 5 | Small apartment | BRRRR | $1,200 | $70,000 |

| 8 | Commercial unit | Commercial investing | $2,500 | $160,000 |

Conclusion

Building and growing a real estate investment portfolio is a long term path that rewards patience and smart planning. The key is to start with a clear property investment strategy, research the market, and choose the right investment property types. Beginners should focus on learning the basics, tracking rental income, and ensuring positive cash flow properties before scaling up.

As your portfolio grows, diversification becomes essential. Mixing residential real estate investing with commercial real estate investing, using REIT investing, and adding different locations reduces risk and increases stability. Using leverage in real estate and equity in property can speed up growth, but only when you keep expenses, taxes, and vacancy rates under control.

Real estate is not risk free, but it offers strong rewards when you manage it well. With the right plan, you can create a steady income stream and build wealth over time. The best investors stay patient, stay informed, and always focus on long term growth. If you follow the steps in this guide, you can build a powerful real estate investment portfolio that stands the test of time.

FAQs:

What is the 3 3 3 rule in real estate?

The 3-3-3 rule means you should have 3 months of mortgage payments saved, your property should rent within 3 weeks, and you should be able to sell it within 3 months if needed.

What is the 10/5/3 rule of investment?

The 10/5/3 rule suggests 10% down payment, 5% annual return, and 3% growth as a safe investment guideline for rental properties.

When buying investment property, questions to ask?

Ask about rental demand, neighbourhood safety, property taxes, repair costs, and expected rental income, and check if the area has strong job growth and good schools.

What is the 50% rule in rental property?

The 50% rule says that about half of your rental income will go to expenses like repairs, insurance, taxes, and property management, not counting the mortgage.

What is the 80/20 rule for rental property?

The 80/20 rule means 80% of your profits come from 20% of your properties, so focus on high-performing rentals and improve them for better returns.